Base Paper for Heat Sealable Packaging Market Size, Manufacturing Cost Trends, Pricing Analysis, Company Profiles, and Regional Insights

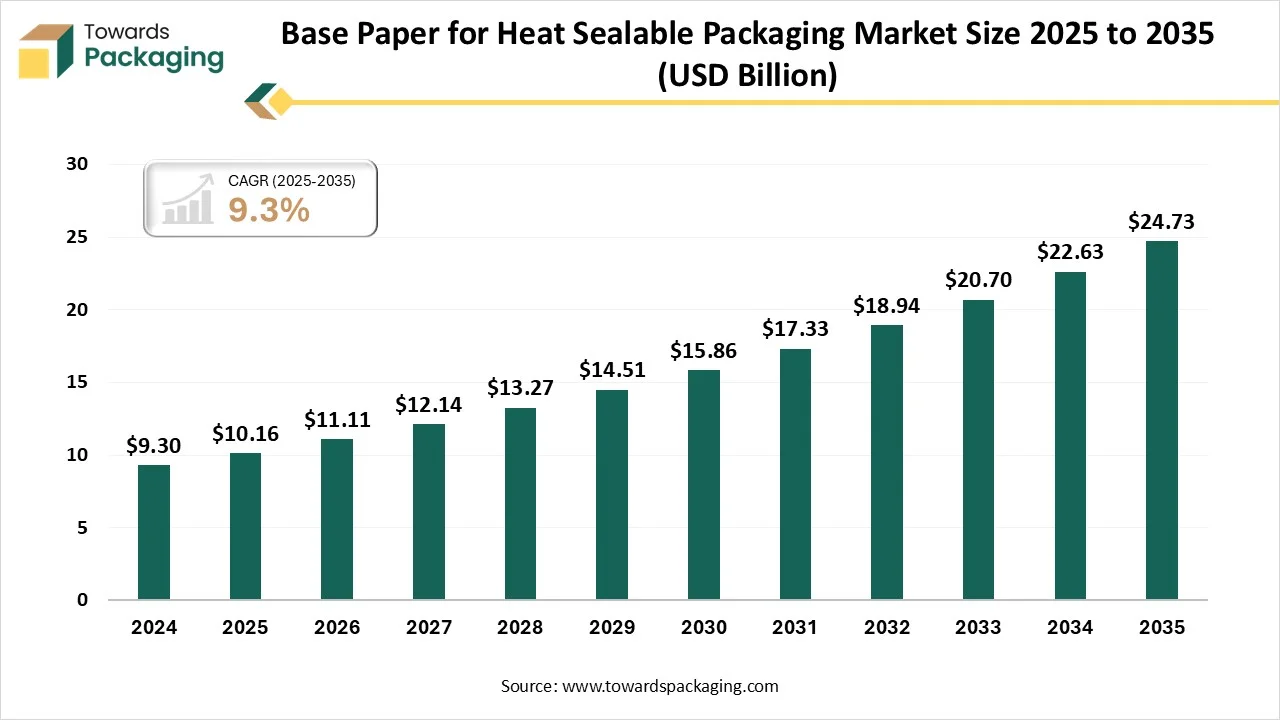

According to Towards Packaging consultants, the global base paper for the heat sealable packaging market is projected to reach approximately USD 24.73 billion by 2035, increasing from USD 10.16 billion in 2025, at a CAGR of 9.3% during the forecast period 2026 to 2035.

Ottawa, Feb. 13, 2026 (GLOBE NEWSWIRE) -- The global base paper for the heat sealable packaging market hit USD 10.16 billion in 2025, with current forecasts pointing to USD 24.73 billion by 2035, according to Towards Packaging, a sister firm of Precedence Research.

Request Research Report Built Around Your Goals: sales@towardspackaging.com

What is Meant by Base Paper for Heat Sealable Packaging?

Base paper for the heat sealable packaging is a specially engineered, high-performance, and sustainable substrate typically made from wood pulp that is designed to be coated with heat-activated adhesives like PE or dispersion coatings. It acts as a renewable, printable, and recyclable alternative to traditional plastics, enabling strong, secure, and airtight sealing for food, pharmaceutical, and consumer goods.

Get All the Details in Our Solutions - Access Report Sample: https://www.towardspackaging.com/download-sample/5939

Manufacturing Cost Trends for Heat Sealable Base Paper

The cost of base paper used in heat sealable packaging has been steadily increasing over recent years. This is due to a combination of factors, including the rising costs of raw materials (like pulp and chemicals), energy costs, and the added value of coatings used to make the paper heat-sealable. Below is a table outlining the typical manufacturing cost ranges for base paper used in heat-sealable packaging.

Manufacturing Cost Range for Heat Sealable Base Paper (USD/tonne)

| Year | Low (USD/tonne) | High (USD/tonne) | ||

| 2020 | $ | 800 | $ | 1,200 |

| 2021 | $ | 830 | $ | 1,240 |

| 2022 | $ | 860 | $ | 1,280 |

| 2023 | $ | 880 | $ | 1,320 |

| 2024 | $ | 900 | $ | 1,350 |

| 2025 | $ | 920 | $ | 1,380 |

| 2026 | $ | 950 | $ | 1,420 |

| 2027 | $ | 980 | $ | 1,460 |

| 2028 | $ | 1,020 | $ | 1,500 |

| 2029 | $ | 1,060 | $ | 1,540 |

| 2030 | $ | 1,100 | $ | 1,580 |

| 2031 | $ | 1,145 | $ | 1,630 |

| 2032 | $ | 1,190 | $ | 1,680 |

| 2033 | $ | 1,240 | $ | 1,730 |

| 2034 | $ | 1,290 | $ | 1,780 |

| 2035 | $ | 1,340 | $ | 1,830 |

Key Insights:

- The low-end prices reflect base paper for simpler applications, while the high-end costs are associated with more complex coatings and higher performance specifications required for heat sealability.

- The price increase year-over-year is attributed to a variety of factors, including material costs, advancements in coating technology, and the value-added features that make the paper suitable for heat sealing applications.

Selling Price Range for Heat Sealable Base Paper to Packaging Manufacturers (USD/tonne)

The prices paid by packaging manufacturers for heat-sealable base paper include the manufacturing cost plus additional premiums for logistics, grade specifications (such as barrier properties), and packaging performance. The table below shows the estimated selling prices that packaging producers pay for this paper.

| Year | Low (USD/tonne) | High (USD/tonne) | ||

| 2020 | $ | 900 | $ | 1,350 |

| 2021 | $ | 930 | $ | 1,400 |

| 2022 | $ | 970 | $ | 1,450 |

| 2023 | $ | 1,000 | $ | 1,500 |

| 2024 | $ | 1,030 | $ | 1,540 |

| 2025 | $ | 1,060 | $ | 1,580 |

| 2026 | $ | 1,100 | $ | 1,630 |

| 2027 | $ | 1,150 | $ | 1,690 |

| 2028 | $ | 1,200 | $ | 1,750 |

| 2029 | $ | 1,250 | $ | 1,810 |

| 2030 | $ | 1,310 | $ | 1,880 |

| 2031 | $ | 1,370 | $ | 1,950 |

| 2032 | $ | 1,430 | $ | 2,020 |

| 2033 | $ | 1,500 | $ | 2,090 |

| 2034 | $ | 1,570 | $ | 2,180 |

| 2035 | $ | 1,650 | $ | 2,260 |

Key Insights:

- The selling price includes additional costs such as logistics, manufacturer margins, and the premium for heat-sealable coatings and barrier properties.

- These prices reflect the demand for higher performance packaging materials, especially in sectors like food, beverages, and pharmaceuticals, where airtight, contamination-resistant seals are crucial.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Leading Companies in Heat Sealable Packaging

Several global companies dominate the production of heat sealable packaging and the manufacturing of base paper used for these applications. The table below highlights some of the key players and their contributions to the market.

| Company | 2024/2025 Revenue | Employees | Packaging Focus (Heat Seal Relevant) | Notes / Metrics |

| Amcor plc | ~US$15 billion | 77,000 (2025) | Global flexible and specialty packaging including heat sealable films and pouches | One of the world’s largest flexible packaging firms, serving food, pharma, and FMCG markets. |

| Sealed Air Corporation | US$736 million operating income (2024) | 16,400 (2024) | Cryovac heat-seal food packaging, protective & barrier packaging | Known for its Cryovac brand used for heat-sealed food trays and packaging. |

| Huhtamäki Oyj | Multi-billion EUR revenue (2023) | ~18,261 (2023) | Flexible packaging, labels, and heat-sealable films for food & beverages | Leading flexible packaging provider with significant heat-seal applications in consumer goods. |

| Sonoco Products Company | ~US$7.4 billion (2024 est.) | ~20,000+ | Flexible packaging including pouches and protective films | Focuses on flexible packaging solutions with heat seal applications. |

| Berry Global Group | ~US$16.6 billion (2024) | ~48,000 | Flexible packaging & films with heat seal capabilities | Leader in consumer & industrial packaging with heat-seal films part of its portfolio. |

| Mondi plc | ~€7.5 billion (2024) | ~25,000 | Flexible films, bags & pouches (heat seal types) | European packaging company specializing in heat-sealed packaging. |

| Constantia Flexibles Group | ~€3.1 billion (2023) | ~9,000 | Flexible & laminated heat-sealable packaging | Provides high-barrier heat-seal solutions in pharma and food packaging. |

| Winpak Ltd. | ~CAD ~1.5 billion (2024 est.) | ~3,000+ | High-barrier heat-seal films and rigid packaging | North American heat-seal film supplier for medical & food markets. |

Key Insights:

- Amcor and Sealed Air are leading producers of heat-sealable films and flexible packaging, offering solutions across the food, pharma, and FMCG industries.

- Huhtamäki, Sonoco, and Berry Global have a significant presence in the flexible packaging sector, with a focus on heat-sealable films used in a variety of applications.

Market Insights: Base Paper for Heat-Sealable Packaging

The base paper market for heat-sealable packaging is expected to reach USD 11.11 billion by 2026, driven by the rising demand for flexible packaging solutions, particularly in the food & beverage and pharmaceutical sectors.

| Metric / Data Point | Figure / Value | Context |

| Global Base Paper Market Size (2026) | USD 11.11 billion | Value of base paper used in heat-sealable packaging material. |

| Asia Pacific Share (2025) | Dominant regional share | Driven by demand in F&B and e-commerce sectors. |

| Import Shipments (2024–25) | 959 shipments globally | HSN Code 4804 base paper imported by 82 buyers. |

| Major Export Sources | China, Chile, Japan | Leading exporters of base paper used in heat-sealable packaging. |

| Leading End-Use Segment (2025) | Food & Beverage | Largest application segment due to demand for airtight, contamination-resistant seals. |

| Fastest Growth Segment | Pharmaceutical & Healthcare | Expected to see the fastest growth in heat-sealable packaging usage. |

| Dominant Packaging Format | Pouches / Flexible Films | Stand-up pouches and similar formats commanded largest usage in 2025. |

Key Insights:

- Food & Beverage remains the leading end-use segment for base paper used in heat-sealable packaging, driven by the need for airtight and contamination-resistant seals.

- The pharmaceutical sector is poised for rapid growth in the use of heat-sealable packaging, as the demand for secure, hygienic packaging solutions increases.

Private Industry Investments for Base Paper for Heat Sealable Packaging:

- Mondi (€16 million): Invested in new technology at its Solec plant in Poland to produce FunctionalBarrier Paper Ultimate, an ultra-high barrier, heat-sealable paper designed to replace unrecyclable aluminum foil in food packaging.

- Sappi (Portfolio Expansion): Launched the Seal family of heat-sealable papers, a broad portfolio designed to integrate into existing packaging lines and provide fiber-based alternatives for confectionery and food pouches.

- Ahlstrom (€40 million): Upgraded its production platform in Chirnside, UK, installing advanced machinery to increase manufacturing capacity for heat-sealable tea and coffee filters and other sustainable beverage materials.

- Tetra Pak (€100 million): Commits substantial annual funding to research and development for creating a paper-based alternative to the traditional aluminum foil barrier in aseptic cartons, focusing on full recyclability.

-

Stora Enso (€10 million): Invested in dispersion barrier technology at its Forshaga site in Sweden to develop paperboard with barrier properties that are easier to recycle and have a lower carbon footprint than fossil-based components.

What Are the Latest Key Trends in the Base Paper for Heat Sealable Packaging Market?

- Sustainability & Eco-friendly Focus: The primary driver is replacing plastic with renewable, paper-based alternatives that are both biodegradable and recyclable, such as EcoShield® Heat Sealable Paper.

- Advancements in Technology & Coatings: Innovation in water-based, heat-sealable adhesives allows paper to be sealed on existing, optimized, plastic-oriented machinery with minimal adjustments.

-

Functional Barrier Properties: Growth in demand for coatings that offer grease resistance and moisture barriers for food and pharmaceutical applications.

What is the Potential Growth Rate of the Base Paper for Heat Sealable Packaging Industry?

The global base paper for heat sealable packaging industry is experiencing strong growth, driven by the shift toward sustainable, fiber-based, and recyclable packaging. The market is shifting away from non-recyclable multi-layer laminates toward recyclable, heat-sealable paper solutions. Innovations in barrier coatings and, for instance, Amcor's AmFiber technology, or Parkside's Recoflex, are enabling paper to replace plastic.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardspackaging.com/schedule-meeting

Regional Analysis:

Who is the leader in the Base Paper for Heat Sealable Packaging Market?

Asia Pacific dominated the market in 2025, due to rising packaged food consumption, urbanization, and the expansion of retail and e-commerce sectors. Rapid industrialization and increasing awareness of sustainable packaging are encouraging manufacturers to adopt paper-based heat-sealable materials. The region benefits from a strong pulp and paper manufacturing base and growing investments in flexible packaging infrastructure.

India Base Paper for Heat Sealable Packaging Market Growth Trends

India dominates regional demand due to its massive food processing sector and expanding consumer goods market. Government initiatives promoting biodegradable and recyclable packaging accelerate the adoption of paper-based heat-seal materials. Domestic manufacturers are increasingly investing in coating and converting technologies, enabling large-scale production of heat-sealable base papers for snacks, frozen foods, and takeaway packaging.

North America’s Growing Base Paper for Heat Sealable Packaging Industry

North America is expected to experience the fastest growth in the market during the forecast period, supported by strong demand from food service, ready-to-eat meals, medical packaging, and e-commerce applications. Sustainability initiatives and regulatory pressure to reduce plastic usage are accelerating the shift toward paper-based flexible packaging. The region’s advanced converting infrastructure, high consumption of packaged foods, and emphasis on recyclable and compostable materials continue to drive innovation in coated and specialty heat-seal papers.

US Base Paper for Heat Sealable Packaging Market Trends

The U.S. leads regional demand due to its large food processing industry, expanding quick-service restaurant sector, and growth in sustainable packaging adoption. Increasing consumer preference for eco-friendly packaging and retailer commitments to reduce plastic waste push manufacturers toward paper-based heat seal solutions. Strong R&D capabilities and investments in barrier coating technologies also enhance domestic production of high-performance base papers suitable for moisture and grease resistance.

More Insights of Towards Packaging:

- Sanitary Food and Beverage Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Ready-to-Use Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- Europe Glass Prefilled Syringes And Glass Vials Packaging Equipment Market Size, Trends and Competitive Landscape (2026–2035)

- Asia Pacific Food Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Europe Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

- North America Pharmaceutical Packaging Market Size and Segments Outlook (2026–2035)

- North America Post-Consumer Recycled Plastics Food Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Transfer Molded Pulp Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Europe Food Packaging Market Size and Segments Outlook (2026–2035)

- Shrink Label Films Market Size, Trends and Competitive Landscape (2026–2035)

- U.S. Rigid Packaging Market Size, Trends and Segments (2026–2035)

- North America Packaging Market Size, Trends and Regional Analysis (2026–2035)

- North America Plastic Packaging Market Size, Trends and Segments (2026–2035)

- Biopolymer Packaging Market Size, Trends and Segments (2026–2035)

- Next-Generation Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Recycled Materials Packaging Solutions Market Size and Segments Outlook (2026–2035)

- Commercial Printing Market Size, Trends and Competitive Landscape (2026–2035)

- Packaging Films Market Size and Segments Outlook (2026–2035)

- Contract Packaging and Fulfilment Services Market Size, Trends and Regional Analysis (2026–2035)

- Canada Pharmaceutical Packaging Market Size, Trends and Segments (2026–2035)

Segment Outlook

By Sealing Technology

How did the Hot Bar Sealing Segment Dominate the Base Paper for Heat Sealable Packaging Market?

The hot bar sealing segment dominated the market in 2025, as it plays a critical role in heat sealable packaging applications requiring strong, consistent, and high-integrity seals. This method uses controlled heat and pressure through heated bars, making it suitable for thicker laminates and multilayer paper-based packaging structures. It is widely adopted in sctors where seal strength, durability, and contamination resistance are crucial. Growth is supported by increasing demand for tamper-evident and protective packaging solutions.

The clamshell sealing segment is projected to grow at the fastest rate in the market for the forecast period, as it is commonly used in consumer packaging formats where visibility, convenience, and product protection are key. In base paper heat-sealable applications, this technology supports packaging structures that combine paper substrates with sealable coatings or laminates. Rising demand for shelf-ready, user-friendly packaging and the shift toward paper-based alternatives to plastics contribute to the segment’s steady growth.

By Material Type

Which Material Type Segment Dominates the Base Paper for Heat Sealable Packaging Market?

The plastics segment dominated the market in 2025, as it provides strong moisture barriers, flexibility, and reliable sealing performance. These materials are widely used where durability and product protection are priorities, particularly in food packaging and pharmaceutical sachets. However, environmental concerns and regulatory pressures are pushing manufacturers toward recyclable and reduced-plastic solutions, driving innovation in thinner coatings and hybrid paper-plastic structures that balance performance with sustainability requirements.

The multi-layer/composite materials segment is projected to grow at the fastest rate in the market over the forecast period, as it helps to enhance barrier properties against oxygen, moisture, grease, and contaminants. The segment is growing due to increasing demand for functional, high-performance packaging while maintaining a paper-based appearance, though recyclability challenges are encouraging the development of mono-material and eco-designed composites.

By Packaging Format

How did Pouches Segment Dominate the Base Paper for Heat Sealable Packaging Market?

The pouches segment dominated the market in 2025, due to rising demand for lightweight, flexible, and portable packaging. These pouches are common in snacks, powdered products, pet food, and medical supplies. Paper-based pouches with heat-sealable coatings offer branding appeal, sustainability perception, and functional sealing performance. Growth in on-the-go consumption and e-commerce packaging trends further accelerates the adoption of this segment.

The flexible films segment is projected to grow at the fastest rate in the market for the forecast period, as they are widely used in wraps, sachets, and overwrap packaging. These films provide excellent printability, sealing reliability, and adaptability for high-speed packaging lines. The segment benefits from increasing substitution of plastic-only films with paper-based laminates to improve environmental profiles while maintaining performance characteristics required for food safety and product preservation.

By End-Use Industry

Which End-Use Industry Segment Dominates the Base Paper for Heat Sealable Packaging Market?

The food and beverage segment dominated the market in 2025, driven by demand for safe, hygienic, and shelf-stable packaging. Applications include snack wrappers, bakery packaging, instant food pouches, and beverage-related dry product packs. Growing consumer preference for sustainable packaging, combined with regulatory focus on reducing plastic waste, significantly supports the adoption of paper-based heat-sealable materials in this industry.

The pharmaceutical and healthcare segment is projected to grow at the fastest rate in the market for the forecast period, as it is used for sterile packaging, sachets, and medical device wraps where seal integrity and contamination control are vital. Rising healthcare consumption, increased demand for single-dose and portable medical packaging, and the need for traceability and tamper resistance continue to drive market growth.

Recent Breakthroughs in Base Paper for Heat Sealable Packaging Industry

In August 2025, Mondi launched Ad/Vantage Smooth Brown Semi Extensible in August 2025, a kraft paper designed for coated and heat-sealable packaging with a calendered surface for uniform coating. The paper offers high puncture resistance and extensibility, and is verified for recycling in European paper streams.

In September 2025, Seaman Paper introduced a new range of heat-sealable, curbside recyclable paper packaging intended to replace single-use plastic bags. These solutions are FSC-certified and designed for compatibility with existing form-fill-seal and horizontal flow-wrapper equipment.

Top Companies in the Base Paper for Heat Sealable Packaging Market & Their Offerings:

- Uflex Ltd: Provides paper coated with water-based FLEXSEAL technology for oil-resistant, heat-sealable food wraps.

- Coveris Holdings S.A: Offers MonoFlex Fibre paper, designed for recyclability and high-barrier protection in dry food packaging.

- Sonoco Products Company: Produces EnviroFlex Paper, a curbside-recyclable solution featuring integrated heat-seal layers for snacks.

- Sealed Air Corporation: Manufactures heat-sealable paper mailers and fiber bags compatible with automated high-speed fulfillment systems.

- Mondi Group: Features FunctionalBarrier Paper, which provides customizable barrier levels and heat-sealability to replace plastic films.

- Huhtamaki Oyj: Developed fiber-based flexible packaging with heat-seal coatings specifically for dry food and confectionery shelf-life.

- Sappi Limited: Markets Sappi Seal, a functional paper with high heat-seal integrity and integrated mineral oil barriers.

- Berry Global Inc: Supplies paper-based flexible laminates that combine traditional paper aesthetics with modern heat-sealing capabilities.

- Amcor Limited: Offers AmFiber Performance Paper, a high-barrier, recyclable sachet solution for culinary and coffee products.

- Constantia Flexibles: Produces EcoPaper, a mono-material paper range with heat-sealable properties optimized for high-speed packaging lines.

Segment Covered in the Report

By Sealing Technology / Type

- Hot Bar Sealing

- Continuous hot bar sealing

- Intermittent hot bar sealing

- Flat hot bar sealing systems

- Impulse Sealing

- Single-impulse sealing

- Double-impulse sealing

- Low-temperature impulse sealing

- Clamshell Sealing

- Hinged clamshell heat sealing

- Pressure-assisted clamshell sealing

- Retail-ready clamshell sealing

- Blister Packaging

- Paper–plastic blister sealing

- Fully paper-based blister packs

- Thermoformed blister sealing

- Skin Packaging

- Vacuum skin packaging (VSP)

- Heat skin packaging on paperboard

- Food-grade skin packaging

- Other Heat-Sealing Methods

- Ultrasonic-assisted heat sealing

- Dielectric heat sealing

- Hybrid heat-sealing technologies

By Material Type

- Plastics

- Polyethylene (PE)

- Polypropylene (PP)

- Polyester (PET)

- Polyvinyl Chloride (PVC)

- Paper & Paperboard

- Aluminum

- Multi-layer / Composite materials

- Specialty and bio-based materials

By Packaging Format / Application

- Pouches

- Flexible films

- Trays

- Bags

- Lids

- Sachets

- Blister packs

- Other custom formats

By End-Use Industry

- Food & Beverages

- Pharmaceuticals & Healthcare

- Personal Care & Cosmetics

- Consumer Goods

- Industrial & Chemicals

- Agriculture

- Others

By Region

- North America:

- U.S.

- Canada

- Mexico

- Rest of North America

- South America:

- Brazil

- Argentina

- Rest of South America

- Europe:

- Western Europe

- Germany

- Italy

- France

- Netherlands

- Spain

- Portugal

- Belgium

- Ireland

- UK

- Iceland

- Switzerland

- Poland

- Rest of Western Europe

- Eastern Europe

- Austria

- Russia & Belarus

- Türkiye

- Albania

- Rest of Eastern Europe

- Asia Pacific:

- China

- Taiwan

- India

- Japan

- Australia and New Zealand,

- ASEAN Countries (Singapore, Malaysia)

- South Korea

- Rest of APAC

- MEA:

- GCC Countries

- Saudi Arabia

- United Arab Emirates (UAE)

- Qatar

- Kuwait

- Oman

- Bahrain

- South Africa

- Egypt

- Rest of MEA

Invest in Our Premium Strategic Solution: https://www.towardspackaging.com/checkout/5939

Request Research Report Built Around Your Goals: sales@towardspackaging.com

About Us

Towards Packaging is a global consulting and market intelligence firm specializing in strategic research across key packaging segments including sustainable, flexible, smart, biodegradable, and recycled packaging. We empower businesses with actionable insights, trend analysis, and data-driven strategies. Our experienced consultants use advanced research methodologies to help companies of all sizes navigate market shifts, identify growth opportunities, and stay competitive in the global packaging industry.

Stay Connected with Towards Packaging:

- Find us on Social Platforms: LinkedIn | Twitter | Instagram | Threads

- Subscribe to Our Newsletter: Towards Sustainable Packaging

- Visit Towards Packaging for In-depth Market Insights: Towards Packaging

- Read Our Printed Chronicle: Packaging Web Wire

-

Get ahead of the trends – follow us for exclusive insights and industry updates:

Pinterest | Medium | Tumblr | Hashnode | Bloglovin | LinkedIn – Packaging Web Wire | Globbook | Substack | Bluesky | Justdial | Crunchbase | TrustPilot | Bizcommunity - Contact: APAC: +91 9356 9282 04 | Europe: +44 778 256 0738 | North America: +1 8044 4193 44

Our Trusted Data Partners

Precedence Research | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Healthcare Webwire | Packaging Webwire | Precedence Research Insights

Towards Packaging Releases Its Latest Insight - Check It Out:

- Flow Wrap Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- India Molded Pulp Packaging Market Size, Trends and Segments (2026–2035)

- Clear Plastic Film Market Size, Volume, Price and Trends (2026 - 2035)

- Polyethylene Films Market Size, Trends and Volume (2026-2035)

- Thin Wall Packaging Market Size and Segments Outlook (2026–2035)

- Dunnage Packaging Market Size, Trends and Segments (2026–2035)

- Liquid Packaging Market Size and Segments Outlook (2026–2035)

- Food Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Seed Packaging Market Size and Segments Outlook (2026–2035)

- Europe Pharmaceutical Glass Packaging Market Size, Trends and Segments (2026–2035)

- Uncoated Paperboard For Luxury Packaging Market Size, Trends, Share, Trends, Segments, and Regional Insights (NA, EU, APAC, LA, MEA)

- Consumer Packaged Goods (CPG) Market Size, Trends and Competitive Landscape (2026–2035)

- Automotive Parts Packaging Market Size, Trends, Share and Innovations

- North America Yogurt, Cheese & Meat FFS Packaging Market Size, Trends and Segments (2026–2035)

- U.S. Black Rigid Plastic Packaging Market Size, Trends, Key Segments, and Regional Dynamics with Manufacturers and Suppliers Data

- Refillable Packaging Market Size, Trends and Regional Analysis (2026–2035)

- Dairy Product Packaging Market Size and Segments Outlook (2026–2035)

- Middle East Seafood Packaging Market Size, Trends and Competitive Landscape (2026–2035)

- Middle East Packaging Machinery Market Size, Trends and Segments (2026–2035)

- Biofoam Packaging Market Size and Segments Outlook (2026–2035)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.